Three Kinds of Affordable Housing

Whenever "affordable housing" comes up at a community meeting for a rezoning/new development, you can pretty much always expect to hear one particular refrain: this isn't real affordable housing! It's still pretty expensive!

"Affordable housing" is a catch-all term for a lot of different things in a lot of different contexts. The following is how I usually explain it. Not perfect definitions, and somewhat specific to my locality, but this is how I approach the conversation.

In what may seem like a tautology: affordable housing is housing that can be afforded. In the broadest sense, this usually means "a household spends no more than 30% of their income on the cost of housing," where the cost of housing includes rent or mortgage, taxes, insurance.

The first, and generally Best kind of affordable housing has a state or federal subsidy attached to it. This comes in a lot of forms. We used to build public housing projects where rents were capped at a % of income. Over the years, the federal government stopped investing in public housing projects and instead focused on Housing Choice Vouchers, popularly known as Section 8 vouchers. This program provides vouchers that travel with a person, and require landlords to charge no more than a percentage of fair market rent. We do still have programs to fund publicly subsidized housing projects - Low-Income Housing Tax Credits are the broadest & biggest project-based federal program. Corporate entities can purchase tax credits; the money is then apportioned out to private, non-profit, and public housing developers through an application system.

There's more ways to get subsidy, but those are the main tools in the toolbox. At the far end of the spectrum this might include things like Permanent Supportive Housing, homeless shelters, transitional housing - housing that should be entirely paid for through public subsidy. LIHTC projects are on the upper end of the spectrum. Overall, that's the first and most useful kind of affordable housing: deeply subsidized, often income-specific. I usually call this Deeply Subsidized Housing.

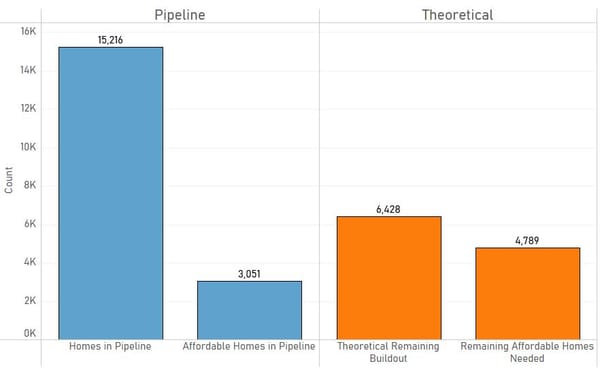

The second kind varies wildly from locality to locality: proffered affordable housing. I'll speak to Albemarle County, VA here, because it's what I know best. This is housing that gets built as part of a new development of market rate housing, usually because of a zoning requirement. For example, in Albemarle: 20% of new units in a rezoned development need to be proffered by the developer as affordable units. For-rent units need to be affordable to a household making 60% of the Area Median Income. Rents for those units are capped at a specific number derived from a calculation based on Area Median Income and size of unit. When zoning code requires developers to include affordable housing, we generally call that "inclusionary zoning."

If you're wondering who pays for that, the answer is: it varies! But someone has to subsidize the affordable units somehow. Pretend you're a private developer building 100 new townhomes: the project has a pro forma detailing the internal rate of return (IRR) and other metrics evaluating the financial viability of the project. Those calculations are based on assumptions about home sale and rent price. If you have some units in the development that have an artificially-lowered rent or sale price, they bring down your calculations. In general, developers need to be able to demonstrate that this project is going to work financially in order to get the financing to actually build.

Albemarle County very recently adopted a program to provide incentive funding back to developers - annual real property tax rebates to the tune of 15% of total taxes due on the development, for 30 years. Other localities take a more aggressive approach to funding inclusionary zoning. Baltimore, for instance, recently updated their policy to grant owners a tax credit "equivalent to the building's actual forgone revenue," as Dan Bertolet over at Sightline puts it. This really helps balance out a pro forma - the missing revenue from affordable units just kinda vanishes. Of course, other localities do nothing at all. Instead, it's up to the developer to make the math work out - essentially building the market-rate units in such a way that they subsidize the cost of the affordable homes. This, as you can imagine, doesn't often work out effectively.

So that's the second kind. Proffered by a developer. Sometimes subsidized, usually by abatements in local property taxes. I should note: I live in this kind of affordable housing! Our home was a proffered for-sale affordable home. I have my beef with the way proffers are designed, but that's a blog post for another day.

The third kind of affordable housing: "Naturally-Occurring Affordable Housing," or NOAH. These are houses that are not publicly subsidized in any way but are still more affordable than other homes in the same market. Usually people use "a family at 80% Area Median Income would spend no more than 30% of their monthly income on housing costs" as a benchmark for NOAH, but definitions vary.

What does that look like in reality? Often older, smaller housing stock. But think of any factor that might lower home values - proximity to a dump, high crime rates, whatever. Any of those factors might "produce" NOAH. Some people refer to housing affordable between 80%-100% AMI as "Workforce Housing;" that's not a term I love, personally. I would group all of that into Naturally-Occurring affordable housing.

An imperfect, generalized taxonomy: Deeply Subsidized, Proffered, and Naturally-Occurring.

So long as we still have housing markets in this country, we do benefit from having all three options out there. Naturally-Occurring affordable housing should fill a gap for folks between 80%-100% AMI. Proffered housing lacks the deep subsidy required to house people below the poverty line, but often is more robustly affordable than NOAH stock. And Deeply Subsidized housing is absolutely one hundred thousand percent necessary to provide homes for everyone.

If we lived in a better country, we'd have far more Deeply Subsidized housing. The federal government needs to return to the days of building public housing projects - and then needs to maintain those projects, instead of allowing them to fall into disrepair. Relying on tax incentives to make little adjustments to the housing market is a band-aid fix. Tax incentives and inclusionary zoning are what we use at the local government level because those are often the only levers of change we can pull - especially in a Dillon Rule state like Virginia, where localities have very limited powers. And I'm going to keep showing up at public meetings to argue in favor of developments that use inclusionary zoning to create proffered affordable homes - right now, we need those homes.

But in the long run? Housing is a human right. On some level, taking a step back from the acronyms and jargon, it almost seems barbaric to talk about housing this way. How dare we play around with tax incentives while our neighbors sleep on mattresses of concrete? What gall it takes to talk about "naturally-occurring affordable housing" when it is entirely unnatural to create a society where some people can't afford housing!

It might seem hard to stay motivated to fight for local affordable housing solutions - three cheers for funded inclusionary zoning! - when the big picture is so dehumanizing. But here's how I see it: we're doing pain management for our society. It's not a cure. But people need housing today, and we know we have a few tools at our disposal to make that happen. We're managing the pain of living in a chronically ill society, building as we do the networks of living tissue we need to one day cure the illness of capitalism.